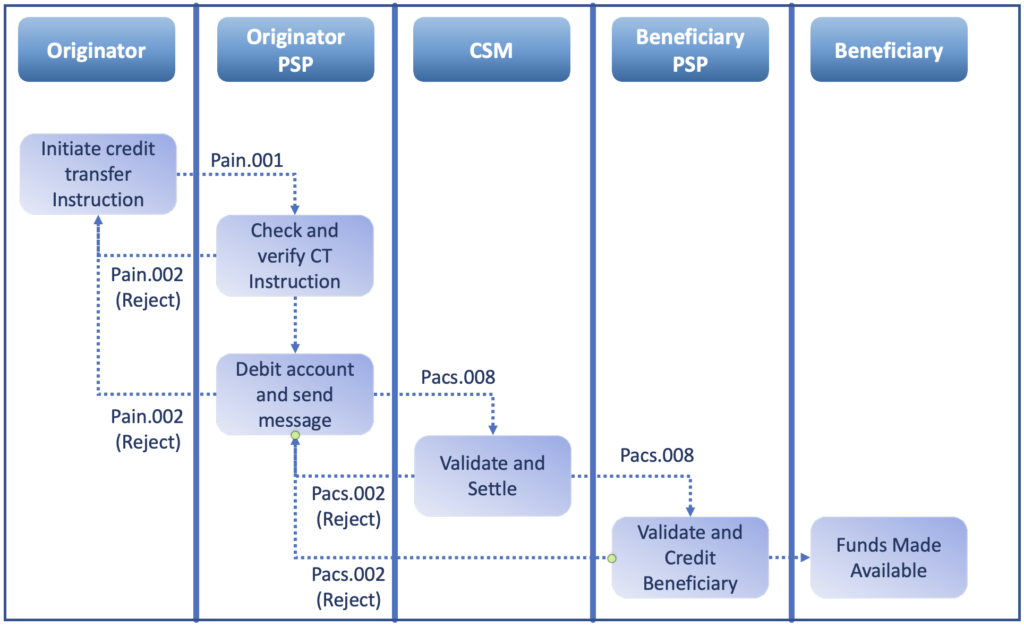

SEPA Credit Transfer – Reject flow :

Even though the happy path is the most common case, there are always exceptions and the different parties in an SCT payment chain can reject the payment due to several reasons. The status of the payment has to be conveyed to the ordering customer so that corrective action can be taken.

Let us try to understand who are all the parties that can send Rejections and how they do it

Reject definition: “A ‘Reject’ occurs when a SEPA Credit Transfer is not accepted for normal execution before inter-PSP Settlement. ” – EPC rule book. The main point to note here is that a payment is rejected before the settlement of the payment happens between banks. In case the payment is settled then the payment has to be Returned (we will get to this in the next article).

Ordering bank (Originator PSP): Upon receiving a Pain.001, the ordering bank (Originator PSP) will start processing the instruction and may decide to reject the payment due to several reasons like non-availability of balance, incorrect information, etc…

After the payment is rejected, the status should be communicated to the ordering customer. This is done by sending a pain.002 message to the ordering customer (usually a corporate customer)

In the below picture we can see that the originator PSP can reject the payment during the validation of the instruction from the originator or during debiting the originator. In both cases pain.002 is sent to the originator.

An interesting point to note is that even if the payment is not rejected and the payment is successfully processed by the ordering bank, a pain.002 is sent by the ordering bank to the ordering customer to indicate the successful processing. pain.002 is used for communicating positive and negative statuses.

CSM: Once a Pacs.008 is sent by the ordering bank (Originator PSP) to the CSM and the CSM decides to reject the payment due to reasons like the incorrect format of the message then it sends a pacs.002 to the ordering bank.

Beneficiary Bank (Beneficiary PSP): This is a rare case where the banks clear funds bilaterally (No CSM involved) then the beneficiary bank/Beneficiary PSP sends a pacs.002 if it rejects the payment. This pacs.002 message is sent to the originator PSP.

Here is a picture of SEPA Credit Transfer reject flow

Link to SCT rulebook and the next article Return Flow

Blog Comments

Safina Shaikh

September 28, 2021 at 9:56 am

Could you please explain the process in case of incoming file gets rejected during instruction processing?

Santosh

September 28, 2021 at 11:32 am

Hello,

Can you please explain what you meant by “Instruction Processing” ?